Response to Climate Change

Background to initiatives

The Paris Agreement entered into force in 2016 called for efforts to support the transition to a decarbonized society in the face of advancing climate change. As a long-term goal, signatories reached a global consensus to keep the average temperature rise to well below 2°C. In 2021, the Intergovernmental Panel on Climate Change (IPCC) published its Sixth Assessment Report containing the latest scientific findings relating to climate change, while at the COP26 United Nations Climate Change Conference, nations adopted the Glasgow Climate Pact with a goal to limit the average global temperature rise to no more than 1.5°C above pre-industrial levels.

It was against this backdrop that Milbon recognized climate change as a real risk with implications for management strategy and financial planning over the medium to long term and positioned it as a Key Challenge as part of its Sustainability Commitment. The Milbon Group has set a target to achieve carbon neutrality of Scope 1 and 2 emissions by 2050. To meet this target, we believe we need to both put in place organizational structures that can make quick decisions for progress on decarbonization and to work together with all stakeholders. Through disclosure of information to, and dialogue with, all stakeholders relating to climate change, we aim to ensure information transparency while elevating our climate change activities and disclosure to a new level, thereby stepping up our contribution to realizing a sustainable society.

Milbon declared its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in December 2022 and became a member of the TCFD Consortium, a Japanese organization comprised of corporations supporting the TCFD recommendations, in January 2023. Milbon will continue to take proactive steps to address climate change while disclosing information in line with the TCFD recommendations.

Governance and risk management

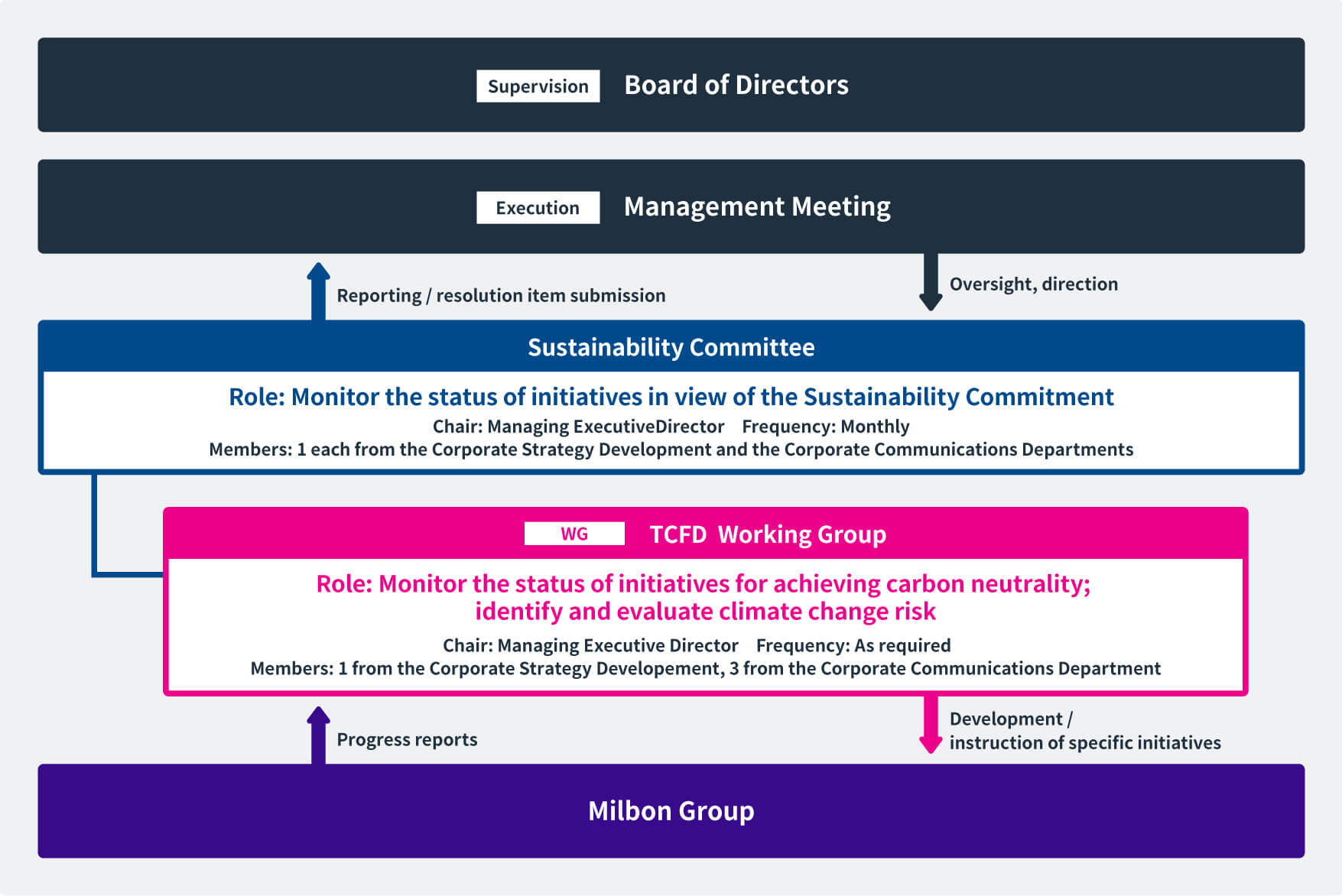

Milbon views sustainability-related issues as significant business challenge and has put in place a promotion framework for resolving those issues. Specifically, the Sustainability Committee, chaired by the Managing Executive Director, meets once a month. The Sustainability Committee examines and discusses policy on climate change action and issues around implementation of related measures with details reported, or submitted for discussion, to the Management Meeting and the Board of Directors as required. The Board of Directors regularly supervises this process, instructing courses of action and adjusting strategy accordingly.

Installed beneath the Sustainability Committee, the TCFD Working Group is responsible for exploring specific measures for realizing the organization’s carbon neutrality target, deploying those measures across the Milbon Group, and managing and monitoring the progress of initiatives, as well as reporting to the Sustainability Committee on the progress or status of initiatives.

The TCFD Working Group also identifies climate change-related risks to the organization. Once every half year, the TCFD Working Group reports on the status of its activities to the Management Meeting and the Board of Directors via the Sustainability Committee and receives supervision from the Board of Directors.

Matters covered in deliberation by the Sustainability Committee and the TCFD Working Group in FY2022 include the formulation of ethics, human rights, and environmental policies; management of progress of the Five Key Challenges under the Sustainability Commitment; implementation of scenario analyses and reporting on findings; and formulation of annual targets supporting attainment of carbon neutrality by the Milbon Group.

Structure

Strategy

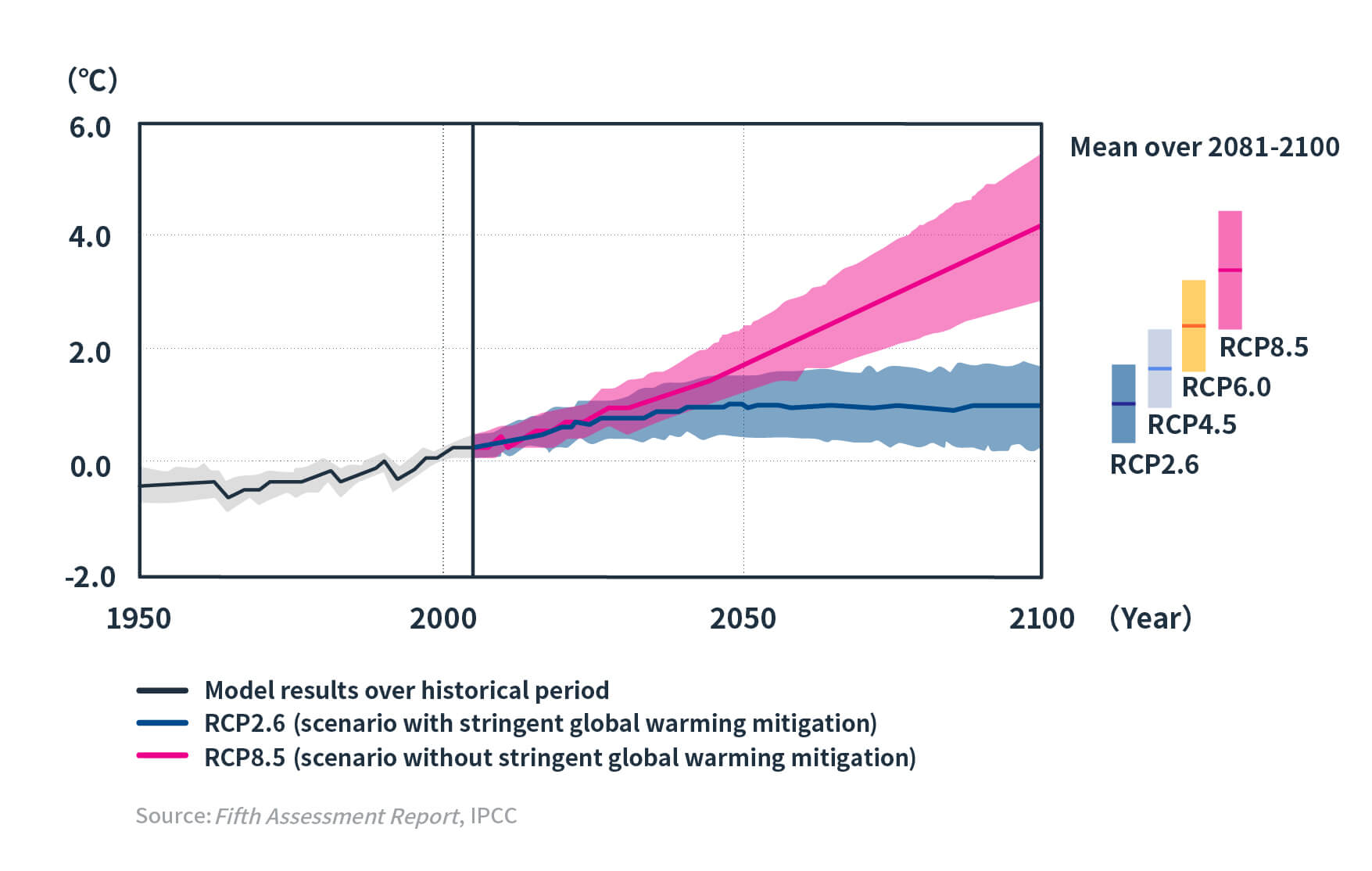

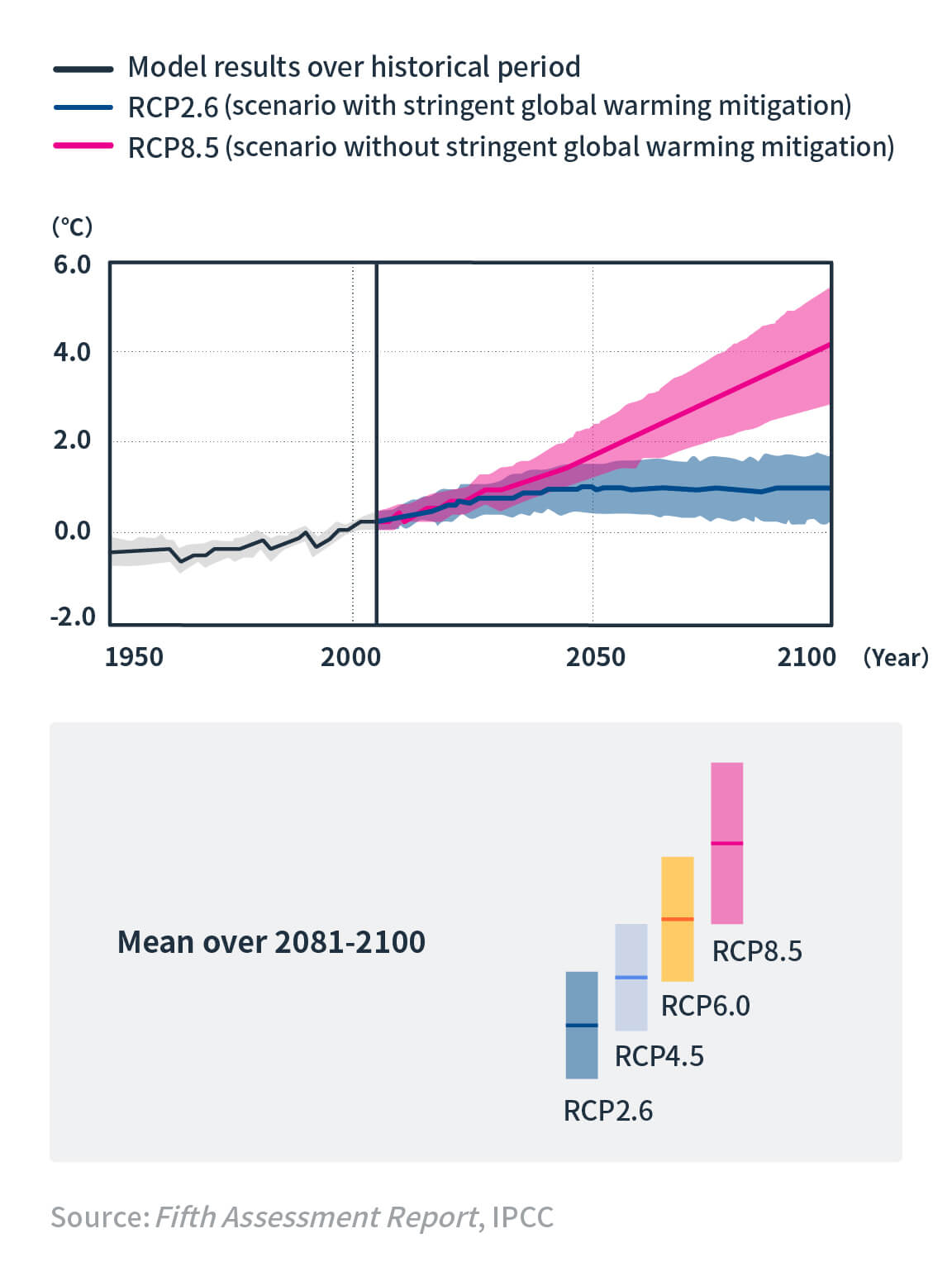

For this, the first fiscal year of TCFD disclosure, we conducted a scenario analysis of Milbon Co., Ltd., the standalone core of the Milbon Group. For the scenario analysis, we envisaged temperature rises of 1.5°C and 4°C and examined the risks and opportunities presented by climate change at three points in time—the years 2025 (short-term), 2030 (medium-term), and 2050 (long-term). Scenarios provided by the IPCC and the International Energy Agency (IEA) were used for the analysis. For the 1.5°C temperature rise scenario, we analyzed the impact of changes in policy, regulations, technology, markets, and consumer perceptions associated with a transition to a decarbonized society. For the 4°C temperature rise scenario, we analyzed physical impacts resulting from both acute change (e.g. heavy rainfall, floods) and chronic change (e.g. increases in average temperature, changes in annual rainfall).

Global average surface temperature change relative to 1986-2005

Results of scenario analysis

Scenario analysis revealed around 40 risks and opportunities for Milbon. The impacts of these risks and opportunities for Milbon Co., Ltd. were evaluated, and responses were considered. Results of scenario analysis showed that Milbon Co., Ltd. would potentially be significantly impacted by increases in raw material procurement costs under both 1.5°C and 4°C scenarios and would potentially be significantly impacted by an increase in the costs of the company’s own operations under the 1.5°C scenario. The results also showed that progress on promoting recycling in manufacturing and consumption activities and practicing people-friendly procurement, as prescribed in Milbon’s Sustainability Commitment, would help minimize identified risks and capture identified opportunities. Measures will also be advanced as part of efforts in other areas.

1.5°C temperature rise scenario

Raw material procurement

| Description of opportunity-risk | Classification | Time frame | Impact | Envisaged responses in the area of raw material procurement |

|---|---|---|---|---|

| Increase in procurement costs due to the introduction or expansion of carbon pricing applicable to suppliers | Risk | 2030 | Large |

Plant-derived raw materials

Containers and packaging materials

|

| Increase in procurement costs resulting from land use constraints due to laws and regulations for protecting forests | Risk | 2025 | Medium | |

| Increase in procurement costs due to strengthening of laws and regulations relating to raw material traceability | Risk | 2030 | Medium |

Milbon’s operations

| Description of opportunity-risk | Classification | Time frame | Impact | Envisaged responses in the area of Milbon’s operations |

|---|---|---|---|---|

| Increase in operating costs due to the introduction or expansion of carbon pricing applicable to Milbon | Risk | 2030 | Small |

Use of our own energy

Response to laws and regulations

|

| Increase in energy costs due to rising retail electricity prices | Risk | 2030 | Medium | |

| Increase in compliance costs due to more stringent laws and regulations at various worldwide locations | Risk | 2030 | Medium | |

| Increase in costs for adapting to a circular economy | Risk | 2030 | Medium | |

| Increase in sales due to a rise in competitiveness as a result of the impact of carbon pricing on competitors | Opportunity | 2030 | Medium | |

| Decrease in emissions and energy costs due to the introduction of in-house power generation | Opportunity | 2030 | Medium |

Demand for products

| Description of opportunity-risk | Classification | Time frame | Impact | Envisaged responses in the area of demand for products |

|---|---|---|---|---|

| Increase in sales of environmentally friendly products | Opportunity | 2030 | Medium |

Product development

|

Degrees of impact have been determined through in-house quantitative evaluation. Specific costs, resulting from carbon pricing for example, are currently being calculated.

4°C temperature rise scenario

Raw material procurement

| Description of opportunity-risk | Classification | Time frame | Impact | Envisaged responses in the area of raw material procurement |

|---|---|---|---|---|

| Increase in the cost of procuring palm oil and other plant-derived raw materials due to climate change | Risk | 2050 | Large |

Procurement

|

| Decrease in procurement costs due to initiatives for ensuring stable procurement of raw materials | Opportunity | 2030 | Medium |

Milbon’s operations

| Description of opportunity-risk | Classification | Time frame | Impact | Envisaged responses in the area of our own operations |

|---|---|---|---|---|

| Increase in costs for repairing damaged manufacturing facilities | Risk | 2050 | Small |

Disaster response

|

| Decrease in sales due to impacts on deliveries and increase in costs due to damaged inventories as a result of flooding and typhoon damage | Risk | 2050 | Small |

Degrees of impact have been determined through in-house quantitative evaluation. Specific costs, resulting from carbon pricing for example, are currently being calculated.

Metrics and targets

Activities to minimize the risk of increases in raw material procurement costs, which scenario analysis results indicate would have the largest impact on our business, will continue through efforts to achieve targets for reduction of petroleum-derived plastic containers and packaging and for procurement of RSPO certified palm oil. To address the risk of increased operating costs due to the introduction of carbon pricing and escalating electricity prices, in addition to our CO2 emission reduction targets for 2030, we have set a new goal for the Milbon Group to achieve carbon neutrality by 2050. With regard to the Milbon Group’s Scope 1 and 2 emissions, first we will aim to achieve carbon neutrality at the Yumegaoka Factory, our manufacturing base and the Japanese business location with the highest CO2 emissions, by 2030. We will then aim to achieve carbon neutrality across the Milbon Group by 2050. We will continue our efforts to minimize risk by regularly monitoring the status of initiatives for achieving carbon neutrality and developing measures to address risks.

Targets for reduction of petroleum-derived virgin plastic (compared to 2020, volume used per unit of net sales)

| 2026 | 2030 |

|---|---|

| 15% reduction in the use of petroleum-derived virgin plastic | 30% reduction in the use of petroleum-derived virgin plastic |

RSPO certified palm oil adoption rate (MB+B&C)

| 2026 | 2030 |

|---|---|

| RSPO certified palm oil adoption rate 50% (MB+B&C) | RSPO certified palm oil adoption rate 100% (MB+B&C) |

Targets for reduction of CO2 emissions (Scope 1 and 2)

| Yumegaoka Factory | Milbon Group |

|---|---|

| 2026: 75% reduction (compared to 2019 levels) | 2050: Carbon neutrality |

| 2030: Carbon neutrality |

Recorded emissions(t-CO2)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Milbon Co., Ltd. Scope 1 | 1,248 | 1,205 | 1,282 | 1,280 | 1,420 | 1,393 |

| Scope 2 (market reference) | 3,151 | 2,707 | 2,559 | 1,442 | 972 | 1,073 |

| Scope 3 | ― | ― | 194,173 | 217,492 | 269,611 | 240,860 |

| Yumegaoka Factory Scope 1 | 502 | 471 | 474 | 500 | 461 | 443 |

| Scope 2 (market reference) | 1,931 | 1,768 | 1,783 | 504 | 0 | 0 |

Specific measures

In April 2022, we began adopting RE100-compliant renewable energy at the Yumegaoka Factory, our production facility, for all its electricity usage. In addition to solar power generation, we have also switched some of our company vehicles to EV and hybrid cars, making significant progress toward achieving a 75% reduction of CO2 emissions by FY2026.